Initial Public Offerings #

Some game worlds allow players to perform an IPO, which stands for Initial Public Offering. At least two weeks after establishing an enterprise, you may apply for a quotation on the AirlineSim stock market and start trading shares publicly.

Basic Rules #

Before we get started, here are some general rules and tips regarding IPOs and stock market transactions that mostly serve to protect new IPOs and avoid illegal actions:

- IPOs can only be subscribed to a maximum of 200% of the offered shares.

- One enterprise can only sign up to 33% of the offered stakes within an IPO.

- Each enterprise that signs an IPO has to prove a significantly increased equity / share capital. The initial starting capital is not part of this.

- The stock rate follows a given base rate, tied closely to the company value, and gives a rough prognosis on the company’s development.

- Stock rate changes through trade will only be possible within +/- 10% of the base rate.

Submitting an IPO #

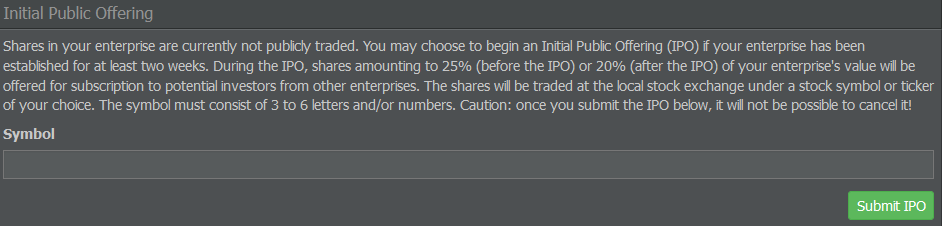

When performing an IPO, shares amounting to 25% (before the IPO) or 20% (after the IPO) of your enterprise’s value will be offered for subscription to potential investors from other enterprises. The shares will be traded at the local stock exchange under a stock symbol of your choice.

If you’re ready to go public, navigate to the Corporate Finance page in the Management tab and choose a stock symbol of 3 to 6 letters and / or numbers. Then, submit your request by pressing the green button. Keep in mind that an IPO can’t be canceled afterwards, so proceed carefully.

Dividend Payouts #

After submitting the IPO, you will have to pay out 15% of every week’s profits to your shareholders. Since the majority of all shares belongs to you (by default, you own 80%, unless you sold some shares separately after the IPO), most of these dividends will float back into your own holding or parent company’s pockets.

Investing #

You’ll also be able to invest in IPOs of other players’ enterprises. In that case, certain rules apply.

General Rules #

If the stock price does not reach 50% (i.e. less than 50% of offered stocks have been signed up for), the IPO will not succeed and you will get a refund.

Between 50% and 100%, you will get your share of investment in the company. For example, if you invested in 25% of all offered stocks, you’ll receive a 5% stake in the enterprise (100% * 20% offered shares * 25% investment = 5%), each share valued at exactly 100 AS$.

Up to 200%, you do get shares for the full value you invested, just less of them at a higher price.

If the quotation surpasses the 200% mark, you will receive your share in the whole investment, at 200 AS$, but only up to the 200% volume.

Examples #

Here’s an example of what happens when the quotation exceeds the 200% mark.

If the base share capital is 10 million AS$ (divided by 100 = 100,000 AS$ shares base float), you’ll have a target market capitalization of 12.5 million AS$ (+25%) at 100%. So the designated value to be signed is 2.5 million AS$ (12.5 million - 10 million AS$) and the upper border will be 200%, meaning you can sign up for a maximum value of 5 million AS$.

The enterprise launching the IPO will always keep 80% of all shares, so 20% are always to be distributed.

Scenario A

Scenario B

Scenario C

Impairment & Company Value #

Basically, the company value divided by the number of stocks equals the base share price. The rules state that a maximum of 10% deviation from this base price is possible.

For the three scenarios mentioned above, this can be summarized as follows:

- A: With 125,000 shares at 12.5 million AS$ company value, the base price is 100 AS$ and the maximum is 110 AS$.

- B and C: With 125,000 shares at 15 million AS$ company value, the base price is 120 AS$ and the maximum is 132 AS$.

Stock prices are recalculated / adjusted on a daily basis, sticking closely to the actual book value. The better the company performs (in terms of cash flow), the quicker the shares rise. A dividend payout is basically a balance sheet contraction, extracting equity, thus leading to stock price depreciations.